Understanding Arizona Property Tax Rates: What You Need to Know

Are you a homeowner in Arizona Property Tax Rates If so, it’s important to understand how property tax rates work in your state. While property taxes can be a bit confusing and overwhelming at first, taking the time to educate yourself can ultimately save you money and help you make informed decisions about your home. In this blog post, we’ll break down the basics of Arizona property tax and provide some helpful tips for homeowners looking to navigate the system. So grab a cup of coffee and let’s dive into everything you need to know! Read more

The Basics of Arizona Property Tax Rates.

Arizona property taxes are an important source of revenue for the state and local governments. These taxes help fund public services like schools, roads, and emergency services. Property tax rates can vary depending on a variety of factors, including the value of your home and where you live in Arizona. In general, Arizona property taxes are based on the assessed value of your home or property. This assessment is conducted by your county assessor’s office every year. The assessed value is then used to calculate how much you owe in property taxes for that year. It’s worth noting that there are two types of assessments: full cash value (FCV) and limited property value (LPV). FCV assessments take into account all aspects of a property when determining its market value. LPV assessments only consider certain factors such as inflation and capped growth rates. Once the assessed value has been determined, it’s time to calculate your actual tax bill. This is done by multiplying the assessed value by the current tax rate for your area. It’s important to note that different areas in Arizona have different tax rates, which means that homeowners in one part of the state may pay more or less than those living elsewhere. Understanding these basics about Arizona property taxes will give you a good foundation for navigating this often complex system as a homeowner in the Grand Canyon State! Read more

How the Property Tax is Calculated in Arizona

Calculating property tax can be a complex process, and Arizona is no exception. The first step is to determine the assessed value of your property. This value is determined by county assessors who use various methods such as market analysis or cost approaches. Once the assessed value has been established, it is multiplied by the local tax rate. In Arizona, this varies depending on where you live and what type of property you own. For example, commercial properties have different rates than residential ones. It’s important to note that certain factors may affect your property tax calculation in Arizona. For instance, if you make improvements or upgrades to your home, this could increase its assessed value and subsequently raise your taxes. Additionally, there are exemptions available for certain types of properties in Arizona such as primary residences or historic properties which can lower their taxable values considerably. It’s also worth noting that every year there are opportunities to appeal property valuations if they seem inaccurate or unjustified so homeowners should stay vigilant with regards to their assessments each year. Understanding how the assessment process works will help ensure accurate calculations and minimize surprises when it comes time to pay taxes each year in Arizona. Read more

Special Considerations for Arizona Homeowners

As a homeowner in Arizona, it’s important to be aware of the special considerations that come with owning property in this state. One thing to keep in mind is that Arizona has some of the highest property tax rates in the country, so it’s crucial to understand how these taxes are calculated and what you can do to reduce them. Another consideration for homeowners is the fact that property values can fluctuate greatly depending on location and market conditions. This means that your home may be worth significantly more or less than when you first purchased it, which can impact your property taxes as well as your overall financial situation. In addition, Arizona homeowners should also be aware of any potential environmental hazards or natural disasters that could affect their property. For example, wildfires are a common occurrence in many parts of the state during dry seasons, while flooding and other types of severe weather events can also pose a threat. Owning a home in Arizona requires careful attention to detail and an understanding of all relevant local laws and regulations. By staying informed about these issues and working closely with experienced professionals like real estate agents and tax experts, you can ensure that your investment remains secure no matter what challenges arise. Read more

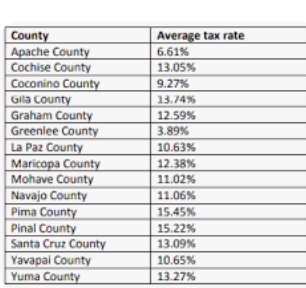

Rates by County in Arizona

Arizona property tax rates vary by county and are determined based on the assessed value of your property. Each county in Arizona has its unique system for determining property taxes, which can have a significant impact on how much you pay. In Maricopa County, for example, the current tax rate is 0.55%, while Pima County has a slightly higher rate at the 0.64%. Other counties such as Yuma and Mohave have lower rates at 0.50% and 0.46%, respectively. It’s important to note that these rates are only part of what determines your overall property tax bill. The assessed value of your home also plays a significant role, as well as any exemptions or credits you may be eligible for. If you’re unsure about the specific tax rate in your county or how it’s calculated, it’s always best to consult with a professional who can help you navigate the complex world of Arizona property taxes. Understanding the different rates by county is crucial when considering purchasing or owning real estate in Arizona. It’s important to take all factors into account when budgeting for homeownership expenses and ensure that you comply with all local laws and regulations related to property taxes.

Commercial Property Tax in Arizona

Commercial property owners in Arizona are subject to property tax, just like homeowners. However, the rules and rates for commercial properties differ from those of residential ones. In general, the tax rate for commercial properties is higher than that of residential properties. The taxable value of a commercial property is determined by its market value multiplied by the assessment ratio. The assessment ratio for commercial properties is set at 18%, compared to 10% for residential properties. This means that a $1 million commercial property would have a taxable value of $180,000. There are also special considerations when it comes to assessing certain types of businesses such as hotels or gas stations. These types of businesses may have additional assessments based on factors such as occupancy rates or fuel sales. For example, some counties offer partial exemptions for new construction or renovations on older buildings used primarily for manufacturing or research purposes. Understanding the nuances of commercial property taxes in Arizona can save businesses significant amounts in annual taxes and should not be overlooked by savvy business owners.

Conclusion

Understanding Arizona property tax rates is an essential part of owning a home or commercial property in the state. As we have seen, the tax rate varies depending on various factors and can be quite complex to understand. However, by knowing the basics of how property tax is calculated, understanding special considerations for homeowners and exploring county-specific rates, you can make informed decisions about your property investments in Arizona. Additionally, taking advantage of homestead exemptions and consulting with experts in commercial property taxes will help you save money while complying with legal requirements. Investing time to learn about Arizona’s property tax system will not only help you avoid surprises but also ensure that you are paying a fair amount of taxes based on your specific situation.